Embark on a captivating journey with our Risk vs Return Reading Quiz, a comprehensive guide that demystifies the intricate relationship between risk and return in the realm of investments. Dive into a world of financial knowledge, where understanding this fundamental concept empowers you to make informed decisions and navigate the investment landscape with confidence.

Delve into the intricacies of risk measurement, unraveling the various methods employed to quantify the potential volatility associated with investments. Explore the nuances of return measurement, grasping the different approaches used to assess the potential gains from your investments. Our quiz will illuminate the delicate balance between risk and return, revealing the trade-offs and strategies involved in managing this dynamic relationship.

Risk and Return Overview

In the world of investing, risk and return are two sides of the same coin. Understanding the relationship between risk and return is crucial for making informed investment decisions.

Risk refers to the possibility of losing some or all of your invested capital. Return, on the other hand, refers to the potential profit or loss you can make on your investment.

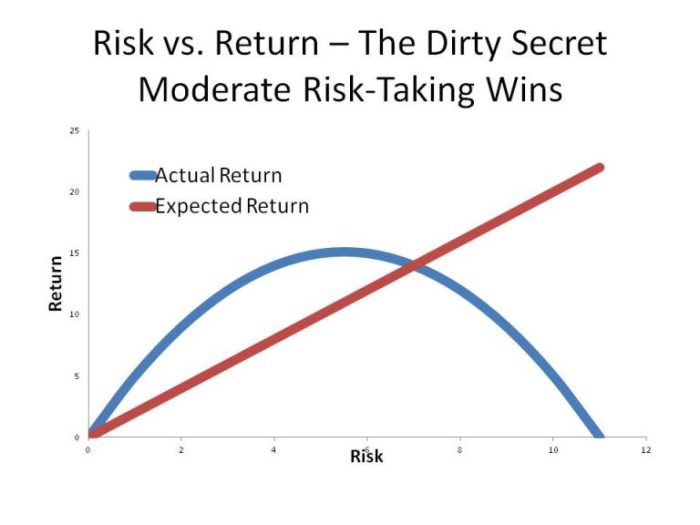

Relationship between Risk and Return

Generally, there is a positive relationship between risk and return. Higher risk investments tend to offer the potential for higher returns, while lower risk investments tend to offer lower returns.

This is because investors demand a higher return for taking on more risk. If an investment is perceived as being risky, investors will only be willing to invest in it if they are offered a potential return that is commensurate with the risk they are taking.

The risk vs return reading quiz is a great way to test your understanding of the concepts. If you’re looking for more practice, check out the apush final exam semester 1 . It’s a comprehensive review of all the material you’ll need to know for the exam.

Once you’ve completed the practice exam, be sure to go back and review the risk vs return reading quiz to reinforce your understanding.

Examples of Different Risk and Return Profiles

Different types of investments have different risk and return profiles. Some common examples include:

- Low risk, low return:Government bonds, money market accounts

- Medium risk, medium return:Corporate bonds, dividend-paying stocks

- High risk, high return:Small-cap stocks, private equity

It is important to note that the relationship between risk and return is not always linear. There are some investments that may offer high returns with relatively low risk, while others may offer low returns with high risk.

Risk Measurement

Risk measurement is the process of quantifying the potential for loss or harm. It is a critical aspect of risk management, as it allows investors to make informed decisions about the risks they are taking.

There are a variety of methods for measuring risk, each with its own advantages and disadvantages. Some of the most common methods include:

- Standard deviation: Standard deviation measures the volatility of a security’s returns. A high standard deviation indicates that the security’s returns are more volatile, and therefore more risky.

- Variance: Variance is a measure of the dispersion of a security’s returns around its mean. A high variance indicates that the security’s returns are more dispersed, and therefore more risky.

- Beta: Beta measures the sensitivity of a security’s returns to changes in the market. A high beta indicates that the security’s returns are more sensitive to changes in the market, and therefore more risky.

- Value at risk (VaR): VaR measures the maximum potential loss that a security could experience over a given period of time, at a given confidence level. VaR is a more sophisticated risk measure than standard deviation or variance, and it can be used to measure the risk of portfolios as well as individual securities.

The choice of which risk measurement method to use depends on the specific needs of the investor. Some investors may prefer to use a simple measure like standard deviation, while others may prefer to use a more sophisticated measure like VaR.

It is important to note that no risk measurement method is perfect. All risk measurement methods have their own limitations, and it is important to understand these limitations when using them.

Return Measurement: Risk Vs Return Reading Quiz

Measuring return is crucial in evaluating investments and understanding their potential outcomes. Various approaches exist to quantify return, each with its strengths and applications.

One fundamental concept in return measurement is expected return. It represents the average return an investment is anticipated to generate over a specific period. Expected return is significant as it provides a basis for comparison with other investments and helps investors make informed decisions.

Return Metrics

Several return metrics are commonly used, including:

- Simple Return:Calculates the percentage change in an investment’s value over a period, excluding any reinvested income.

- Time-Weighted Return:Measures the average annualized return of an investment, considering the impact of compounding.

- Dollar-Weighted Return:Similar to time-weighted return, but it also accounts for the effect of cash flows (deposits and withdrawals) on the overall return.

- Internal Rate of Return (IRR):Calculates the discount rate that equates the present value of an investment’s cash flows to its initial cost.

- Return on Investment (ROI):Expresses the return on an investment as a percentage of the initial investment.

Risk-Return Trade-Off

The risk-return trade-off is a fundamental concept in investing. It states that the higher the potential return on an investment, the higher the risk. This is because investments with higher potential returns typically involve more uncertainty and volatility.

The efficient frontier is a graphical representation of the risk-return trade-off. It shows the optimal combination of risk and return for a given level of investment. Investors can use the efficient frontier to create portfolios that meet their individual risk and return objectives.

Managing the Risk-Return Trade-Off

There are a number of ways that investors can manage the risk-return trade-off. These include:

- Diversification:Diversification is a risk management strategy that involves investing in a variety of different assets. This helps to reduce the overall risk of a portfolio, as the performance of different assets is not perfectly correlated.

- Asset Allocation:Asset allocation is the process of dividing an investment portfolio into different asset classes, such as stocks, bonds, and cash. The optimal asset allocation for an investor will depend on their individual risk and return objectives.

- Rebalancing:Rebalancing is the process of periodically adjusting the asset allocation of a portfolio to ensure that it remains aligned with the investor’s risk and return objectives.

Risk Management

Risk management involves strategies to minimize the potential impact of uncertainties and protect against financial losses. It’s crucial for investors to manage risk to achieve their financial goals.

Effective risk management involves identifying potential risks, assessing their likelihood and severity, and implementing strategies to mitigate them.

Diversification

Diversification involves spreading investments across different asset classes, industries, and geographic regions. By diversifying, investors reduce the impact of a single asset or event on their portfolio.

For example, an investor can diversify by allocating funds to stocks, bonds, real estate, and commodities.

Hedging

Hedging involves using financial instruments to offset the risk of price fluctuations in an underlying asset. For instance, an investor can buy a futures contract to lock in a future price for a commodity.

Insurance, Risk vs return reading quiz

Insurance provides financial protection against specific risks, such as property damage or liability. By purchasing insurance, individuals and businesses transfer the risk to an insurance company in exchange for premiums.

For example, home insurance protects against the risk of damage or destruction of a property due to events like fire or theft.

Detailed FAQs

What is the key takeaway from the Risk vs Return Reading Quiz?

The primary takeaway is the importance of understanding the relationship between risk and return in investments. By comprehending this dynamic, investors can make informed decisions that align with their risk tolerance and financial objectives.

How can I use the knowledge gained from this quiz to make better investment decisions?

The quiz provides valuable insights into risk measurement and return assessment techniques. By applying this knowledge, investors can evaluate potential investments more effectively, considering both the potential risks and rewards involved.

What are some practical strategies for managing risk in my investment portfolio?

The quiz highlights various risk management strategies, such as diversification, hedging, and insurance. By incorporating these techniques into their portfolios, investors can mitigate potential losses and enhance their overall investment returns.